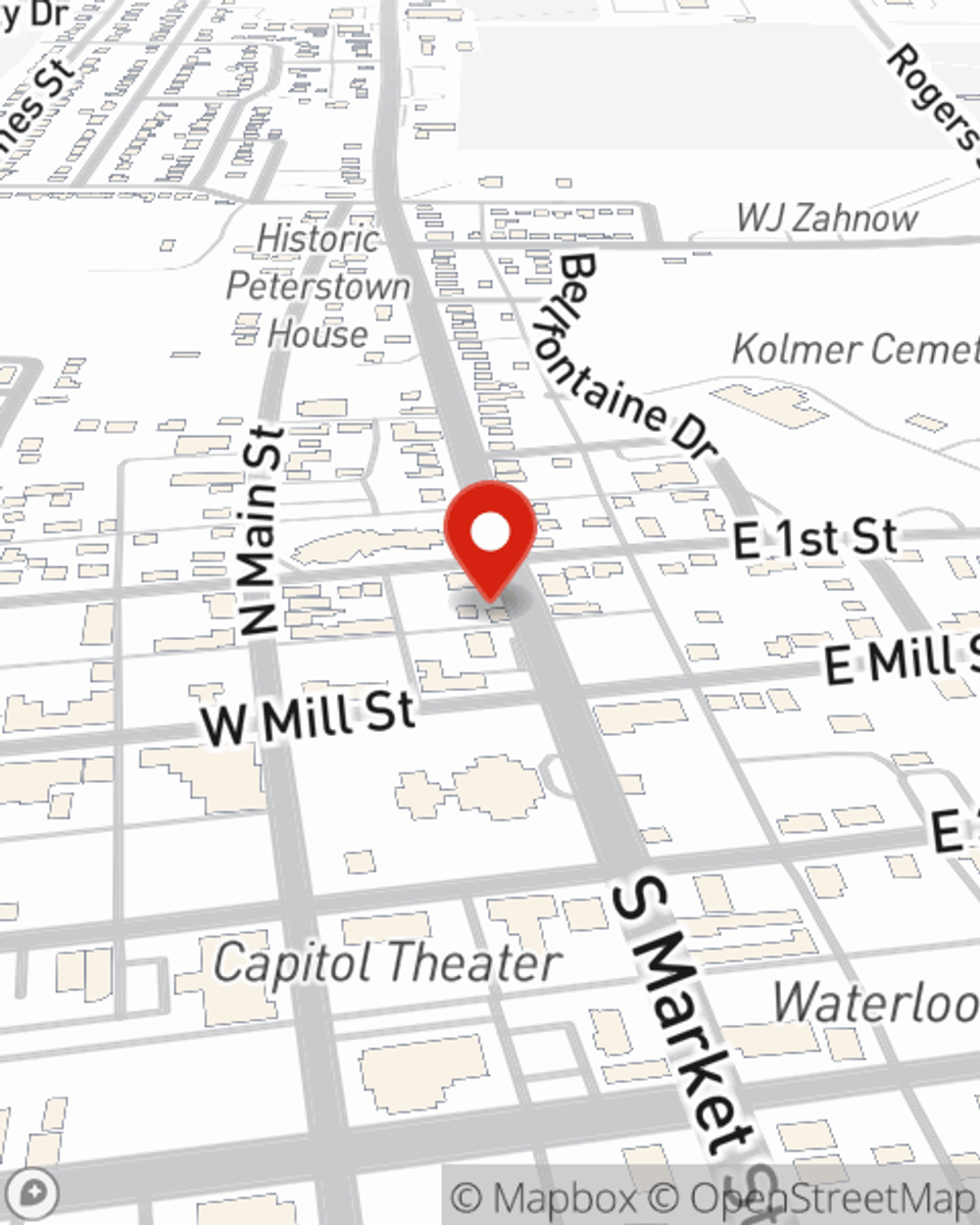

Condo Insurance in and around Waterloo

Get your Waterloo condo insured right here!

Cover your home, wisely

- Columbia

Welcome Home, Condo Owners

Investing in condo ownership is a big responsibility. You need to consider your future needs location and more. But once you find the perfect townhome to call home, you also need fantastic insurance. Finding the right coverage can help your Waterloo unit be a sweet place to call home!

Get your Waterloo condo insured right here!

Cover your home, wisely

Put Those Worries To Rest

Things do happen. Whether damage from lightning, theft, or other causes, State Farm has fantastic options to help you protect your condo and personal property inside against unpredictable circumstances. Agent Chuck Pittman would love to help you build a policy that is personalized to your needs.

If you're ready to bundle or discover more about State Farm's outstanding condo insurance, contact agent Chuck Pittman today!

Have More Questions About Condo Unitowners Insurance?

Call Chuck at (618) 939-9555 or visit our FAQ page.

Simple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Chuck Pittman

State Farm® Insurance AgentSimple Insights®

Help protect yourself from contractor fraud

Help protect yourself from contractor fraud

Shady contractors and home repair scams can cost you. Discover tips to help protect yourself from repair scams and learn how to spot home repair fraud.

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.